DeFi, or decentralized finance, remains one of the fastest growing industries. From 2019 to 2021, the TVL, or total value locked, in DeFi protocols grew 80x. Today, DeFi continues to grow, having surpassed $100 billion in TVL in 2022. DeFi provides the opportunity for anyone to interact with a transparent, open, and secure financial system. DeFi is different from the traditional finance system which has been around for thousands of years. Let’s talk about the differences between the two.

DEFI VS TRADITIONAL FINANCE

- DeFi — DeFi is peer-to-peer financial services using blockchain technology that eliminates the need for intermediaries. Combining programmability with the security of blockchains like Cardano, users can borrow/lend, get insurance, deposit their money for savings, or buy/sell digital assets on DEXs. The key to DeFi is that there is no middleman or central authority. For example, the Securities Exchange Commission, or SEC, in the United States can suspend trading of any security trading on exchanges it regulates, such as the New York Stock Exchange or Nasdaq. To get a loan or open a bank account, a bank can deny anyone these financial services based on nationality or due to the public policy of their governments.

In DeFi, transactions on dApps are executed by smart contracts, not a central authority. Anyone with a crypto wallet and internet connection can participate. - Traditional Finance — Traditional Finance, or Centralized Finance (CeFi), are financial services that have an intermediary or central authority, whose action is needed for people to use their services. For example, to get a loan, people usually have to provide very personal information such as their name, address, Tax ID number, and financial history. Even after receiving this personal information, the bank can choose to deny a person a loan with little explanation. In traditional finance systems, a company or person can be denied the use of financial services by a central authority.

ARCHITECTURE: DEFI VS TRADITIONAL FINANCE

How is DeFi’s technology different from traditional finance? The basic function of a decentralized exchange like the Genius DEX or centralized exchanges like Robinhood is the same, allowing users to trade assets for other assets. However, DeFi uses a distributed ledger technology, or a decentralized blockchain for transactions. No single node has control of the blockchain and all transactions added to the blockchain are immutable. User’s funds are bound by the smart contract of the dApp.

In traditional finance, entities like banks typically keep the ledgers internally. By having sole control of the ledger, the bank can change, cancel, or reverse transactions. Banks can also block who can access their financial services and require users to identify themselves to satisfy KYC guidelines before allowing the use of their services.

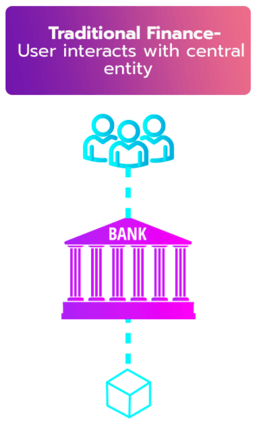

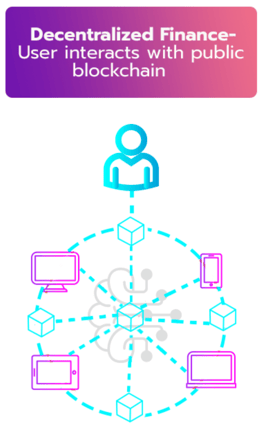

In DeFi, the ledger is distributed and transactions are approved by multiple nodes. In traditional finance, the centralized nodes, or a single entity, controls the ledger. Let’s illustrate the difference below:

The distributed ledger of transactions, or blockchain, is distributed between multiple nodes. When a user interacts with a DeFi protocol on the Cardano blockchain, the potential execution of that transaction is done based on the conditions of the smart contract. When the transaction is executed, it is recorded on the distributed ledger that every full node stores.

On the other hand, if a user interacts with a bank for a savings account or a loan, only the bank has control of the ledger.

SUMMARY

DeFi offers many of the same financial services as traditional finance, such as interest-bearing accounts or loans, but does so without intermediaries. DeFi uses smart contracts with blockchain technology to create a secure, transparent platform to do financial transactions. Most DeFi protocols, such as DEXs, don’t have KYC and don’t limit users by nationality, in contrast to traditional finance companies like banks. Since DeFi protocols utilize public blockchains like Cardano, the ledger is distributed. In many traditional finance companies, the ledgers are internally controlled by a single entity.