Genius Yield is launching a next-generation decentralized exchange (DEX) combined with an AI-powered yield optimizer specifically designed to take advantage of benefits provided by Cardano’s EUTxO smart contracts paradigm.

The Genius Yield Platform protocol distinguishes itself from other protocols in the following ways:

- Smart Swaps - Create a limit, dynamic and algorithmic orders using programmable swaps.

- Highly parallelizable - Achieve high transaction throughput with an order-book architecture designed and optimized for Cardano’s distributed EUTxO data structure.

- Concentrated Liquidity - Reduce impermanent loss, improve capital efficiency, and earn higher rewards.

- Non-custodial & decentralized - Participate in a truly decentralized DEX that fragments pool liquidity and runs a network of independent Smart Order Routers (SOR).

- Smart Liquidity Vault - Earn a passive income from yield optimization strategies by depositing liquidity into AI-managed vaults.

Advantages of Cardano’s EUTxO model over Ethereum’s Account-based model

Cardano’s EUTxO model extends the Bitcoin model with the necessary programmable expressiveness required to support smart contracts.

However, the EUTxO architecture is fundamentally different from the account-based model used by Ethereum. As a result, DApps on Ethereum do not translate well to Cardano and need to be fundamentally redesigned to match Cardano’s underlying ledger structure.

Genius Yield's Platform contains a next-generation DEX that introduces a complete redesign of the traditional AMM and adopts novel design patterns that specifically leverage the benefits provided by the EUTxO paradigm:

- Security - Cardano’s smart contract language Plutus and the EUTxO accounting model are based on a functional programming paradigm (immutable, statesless, and local), resulting in more concise, predictable, and reliable execution.

- Determinism - A transaction’s impact on the blockchain can be predicted and validated locally before it is submitted to the ledger. Therefore, a validated transaction is guaranteed to succeed and the transaction costs are fixed.

- Parallelism - UTxOs inherently fragment the ledger state, making parallel transaction processing desirable. Therefore, smart contract design logic that maximizes parallelism can benefit from a significant increase in throughput.

- Scalability - On Cardano, transaction computation is off-chain and transaction verification is on-chain. This separation of responsibility makes it easier to implement various scaling solutions such as off-chain routing bots, side-chains, and layer-2 solutions like Hydra.

- Composability - The functional paradigm underpinning Cardano facilitates smart contracts composability. Composability enables the emergence of complex behaviors from the interaction of simpler components, like legos.

Strong fundamentals and well-designed primitives not only provide robustness and reliability but also the building blocks for a flexible and composable system. Protocols specifically designed for a EUTxO architecture, like Genius Yield's DEX, can offer novel features not found in EVM protocols.

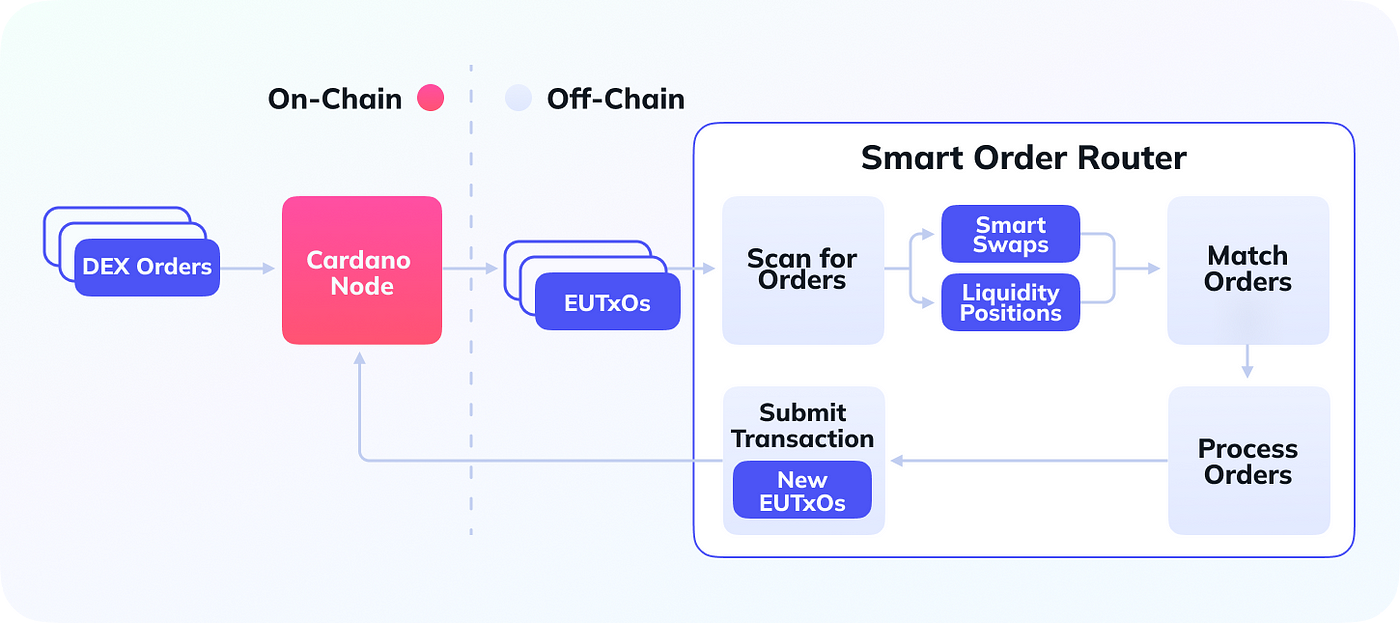

Smart Order Router (SOR)

Smart Order Routers play a crucial role in the DEX’s operational efficiency. They automate the scanning, matching, and processing of orders. They are off-chain bots that execute order-matching algorithms designed to facilitate the order flow across a range of market conditions.

SOR operators earn profits from arbitrage opportunities, such as bid/ask spreads caused by volatility, low trading volumes, and other market inefficiencies.

The highly parallelizable DEX design makes achieving high throughput easier through the distribution of off-chain computation and compatibility with scaling layers like Hydra state channels.

Moreover, SORs promote decentralization since they can be deployed by community stake pools, creating an open and competitive environment for an efficient flow of liquidity, fast order execution, and market-driven pricing.

Overall, the DEX’s design and incentives are optimized to provide a high-performance, secure, and fair DEX experience.

Smart Liquidity Vault

The Smart Liquidity Vault is a powerful secondary protocol built on top of the Genius Yield's DEX. It leverages the DEX’s advanced functionalities and expressiveness to execute AI-powered algorithmic trading strategies.

The user can pick and customize from a number of liquidity management strategies designed by the Genius Yield team and passively benefit from yield optimization opportunities.

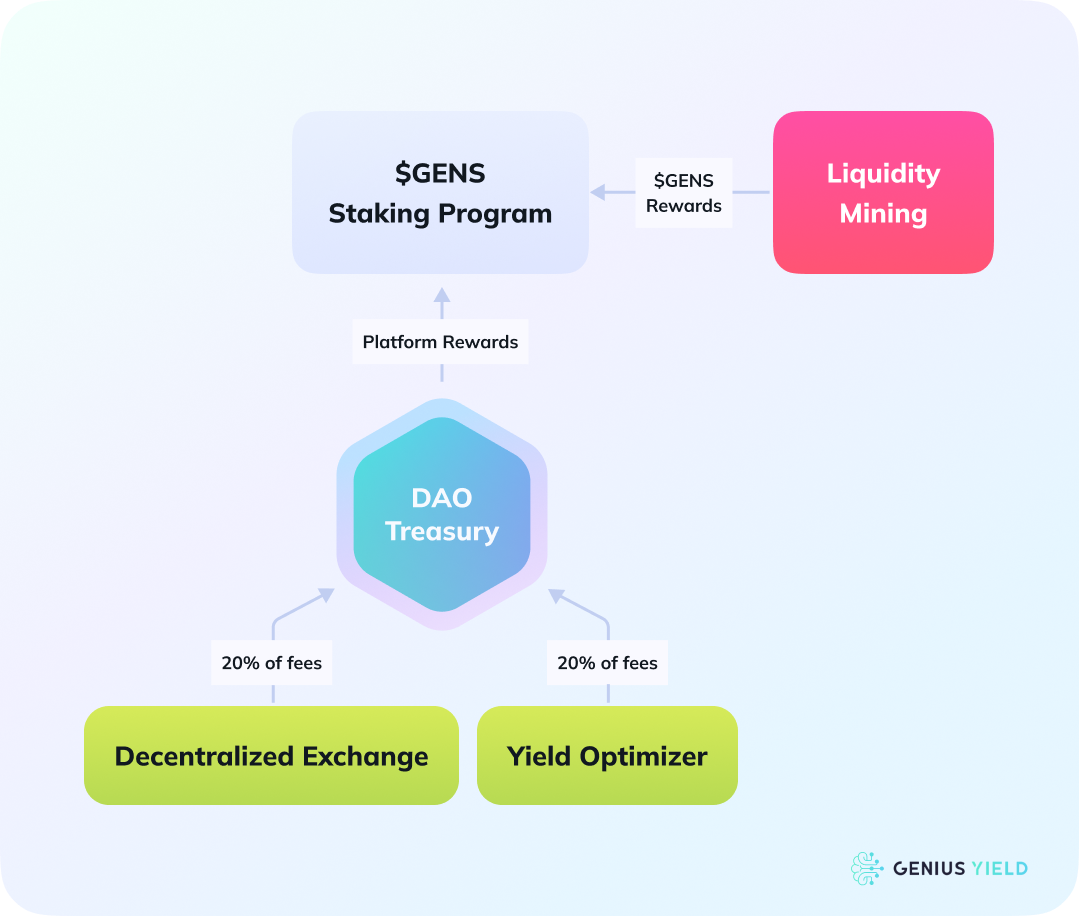

Fee Structure

Genius Yield's DEX

Transacting on the Genius Yield's DEX is cheaper. Unlike other DEXes, Genius Yield's DEX does not charge a “batcher” or “agent” fee for bots that match transactions. Smart Order Routers do not charge a fee to users, instead, they earn profits from the bid/ask spread. Once the order gets executed, a fee, based on the total order value, is shared between the liquidity provider and the Genius Yield DEX. 20% of Genius Yield DEX’s fee is redistributed to $GENS stakers.

Smart Liquidity Vault

The Smart Liquidity Vault fee is made up of two components:

- A management fee — a percentage of the total value locked.

- A performance fee — a percentage of the vault’s profit.

20% of fees accrued are redistributed to GENS stakers.

Genius Yield’s Staking Program

The program allows GENS holders to stake and receives extra rewards from liquidity mining and other in-platform benefits.

What stakers will get from staking $GENS, the native token of the Genius Yield platform:

- 20% of the trading fees from Genius Yield’s DEX will be redistributed to participants of the $GENS Staking Program

- 20% of the Genius Yield’s yield optimizer (Smart Liquidity Vault) fees will be redistributed to $GENS Staking Program participants.

- Governance rights - participants gain voting power in the future development of the Genius Yield platform.

- Genius Pay crypto wallet - additional perks

Conclusion

Genius Yield's DEX is a next-generation DEX architecture designed to take advantage of benefits provided by EUTxO smart contracts, such as security, determinism, parallelism, scalability, and composability.

It offers powerful features like Smart Swaps, which enables programmable and composable orders, and concentrated liquidity, which provides higher capital efficiency and higher yield opportunities.

In addition, Smart Liquidity Vaults leverage the Genius Yield DEX to provide yield optimization opportunities by automating algorithmic trading strategies.

The overarching objective is to democratize DeFi for everyone by providing an all-in-one solution to yield optimization opportunities.

For more information, please check out the Genius Yield Platform whitepaper (https://www.geniusyield.co/whitepaper)

Disclosure

This summary is for informational purposes only.

The content of this summary and the DEX protocol design are in draft form. Genius Labs reserves the right to change, and make any corrections as it sees fit.