History

The biggest technological innovation involving blockchains are cryptocurrencies. Multiple motives over the years have led the push for blockchain technology. Some wanted money free from government control after multiple economic crises and inflation. Others wanted a way to certify the authenticity of documentation in a public way that was resistant to fraud. The origin of blockchain can be traced back decades before bitcoin was released.

In 1983, David Chaum published a paper about creating anonymous electronic money using a software called eCash that used RSA blind signatures, a cryptographic technique that achieved unlinkability between spending and withdrawal transactions. eCash would be digitally stored money on your local computer that was cryptographically signed by a bank. In addition, any user or vendor could spend or receive eCash without setting up an account or any identifiers. Sound familiar?

In 1991, Stuart Haber and W. Scott Stornetta envisioned what we know today as blockchain. Their work centered around creating a cryptographically secured chain of blocks whereby no one could tamper with the timestamps of the documents. Later in 1992, they upgraded their system to incorporate Merkle trees, which enhanced efficiency and allowed the collection of multiple documents into a single block.

The person most famous for successfully combining all of these ideas into a technology that could be used is Satoshi Nakamato. In January 2009 Nakamato released bitcoin, a decentralized digital currency that could be sent from user to user with no intermediary. In addition, transactions were secured through cryptography and publicly recorded on a blockchain.

Blockchain technology is the foundation of cryptocurrency. In fact, without blockchain technology, decentralized cryptocurrencies like Cardano and Bitcoin wouldn’t be possible. Cryptocurrencies are protocols built on top of the blockchain, using blockchain technology to accurately record transactions. Let’s spend some time learning the basics about blockchain.

Blockchain 101

A blockchain is a distributed database or list of transactions that is maintained electronically. The ledger is shared among many different nodes, or computers, who support the maintenance of the database. A node, when referring to cryptocurrencies, is a computer that connects to a cryptocurrency platform like Cardano or Bitcoin. Nodes store a full copy of blockchain and support a blockchain by validating and propagating transactions. There are two types of nodes:

- Full nodes - These nodes store a full copy of a blockchain. Some full nodes also validate and propagate, or relay transactions, to other nodes. The more copies of a blockchain, the more secure the blockchain. Most well known blockchains like Cardano and Bitcoin have thousands of full nodes.

- Lightweight nodes - These nodes don’t download a full copy of blockchain. They do download information such as block headers to validate the authenticity of transactions.

Below are some key attributes of blockchains.

A. Decentralization

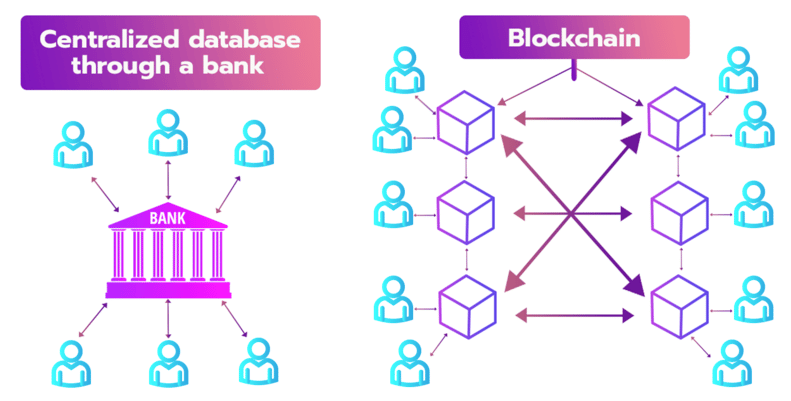

Blockchains are decentralized because many different nodes maintain a list of all transactions. When only one entity, such as a bank or government, has important documents such as property ownership or managing transactions for individuals, there is significant single party risk. If the party fails, the database could be lost forever. The figure below illustrates the decentralization provided by a blockchain.

Fig. 1: A decentralized blockchain of transactions and a centralized database through a bank

Fig. 1: A decentralized blockchain of transactions and a centralized database through a bank

In the first picture, we see that the blockchain, or list of transactions, is maintained by multiple nodes that store the transactions and share updates to the blockchain with each other. In addition, when individuals want to interact with blockchain, such as buying or selling the ADA native coin on the Cardano platform, they can interact through any of the nodes. As long as there are nodes available to store and handle transactions, the blockchain’s existence can continue. There are over 3,000 full nodes called stake pool operators (SPOs) who maintain the Cardano blockchain.

On the other hand, many people have a checking or savings account through a bank. The bank is centralized as it is the sole entity with full power to approve, reverse, and block transactions. While some argue that having these centralized databases that are controlled by a single entity is important to reverse improper transactions and prevent fraud, the drawbacks may outweigh the benefits. Many people can have their funds locked due to economic sanctions or have their access restricted from certain financial services only because of their country of origin. Unlike centralized services like banks, decentralized blockchains like Cardano allow everyone to participate.

B. Security

With so many different nodes, how do blockchains stay secure? The full nodes, such as the stake pool operators for Cardano, ensure the security of the network by validating and executing transactions. Nodes will review and verify each transaction, rejecting fraudulent or wrong transactions. Nodes for blockchains like Cardano or Ethereum are typically paid for adding transactions to the blockchain in a native coin like ADA and therefore have a strong financial incentive to make sure there are no false transactions on the blockchain. An untrustworthy blockchain would have a lower value, hurting the earnings nodes receive for maintaining the blockchain.

C. Immutability

Once transactions are added to a blockchain like Cardano or Bitcoin, it is permanent and cannot be reversed, edited or deleted. Due to the nature of blockchains, the more blocks that are appended after a particular transaction, the stronger its immutable guarantee is.

D. Transparency

Most blockchains like Cardano are public. The transaction details of any transaction can be verified by anyone, and it is possible to follow the path of assets between wallets. Since addresses offer the owner pseudonymity however, there is no way to determine someone's identity from this blockchain information. Blockchain explorers are widely available for reviewing transaction details.

E. Ease of Use

Most blockchains like Cardano and Ethereum are permissionless, meaning anyone can use them. All that is required is an internet connection. There are no KYC (Know-Your-Customer) or AML (Anti-Money Laundering) provisions that prevent usage. This benefits citizens of countries who don’t have adequate banking, proof of identity, or favorable credit history, or who aren’t allowed to use centralized financial services due to their nationality.

F. Ownership

Each person has ownership and responsibility of the cryptocurrency, which is recorded on the blockchain. Each cryptocurrency wallet, such as Eternl or Yoroi Wallet for ADA, has a public and private key. The public key is available on the blockchain for everyone to see and is given out so wallet owners can receive funds.

The private key is used to sign transactions and should not be shared with anyone or only trusted parties. A person with your private key can steal your funds. Private keys are generated through a 12–24 word seed phrase when creating a wallet. This seed phrase should be securely stored. Many people recommend securing their cryptocurrency via a hardware wallet.

Ownership gives full control of the cryptocurrency to each user. If the user loses the seed phrase, access to funds could be gone forever.

Summary

- Blockchains are distributed databases of transactions. Blockchains are decentralized when the validation, execution, and history of transactions are maintained by a network of many nodes that are not controlled by any single entity. This allows secure peer-to-peer transactions without the need for a centralized authority.

- Nodes validate transactions to keep the database secure. Transactions added to the blockchain are immutable, and cannot be changed.

- Many cryptocurrency blockchains, such as Cardano, are permissionless, allowing anyone to use them. In addition, users have full ownership over their funds, where no centralized authority can stop them from receiving and sending funds if they hold their cryptocurrency in a personal wallet. In addition, the user has full responsibility for the security of the funds. If someone steals the private key to their wallet or the user loses their seed phrase, their funds could be stolen or unusable forever.