Stablecoins are blockchain-based digital assets that are linked to an external value, typically the US dollar, and maintain a consistent 1:1 exchange rate.

History

In the early days of cryptocurrencies, traders typically traded highly volatile crypto assets like Bitcoin because they had limited options. In 2014, BitUSD was introduced as an attempt to create a digital currency tied to a reference point and would therefore mitigate price fluctuations. Although BitUSD ultimately lost its peg, it paved the way for the creation of stablecoins that were backed by cryptocurrencies.

Tether (USDT) was introduced in 2015 and is the oldest fiat-backed stablecoin, which has successfully maintained its peg to the US dollar. However, its centralized structure and lack of transparency have led to several issues over the years.

In 2017, MakerDAO launched a decentralized lending protocol, which led to the creation of DAI. It is considered to be the first decentralized and crypto-backed stablecoin and, together with MakerDAO, achieved significant adoption in the DeFi sector.

After fiat- and crypto-backed stablecoins emerged on the market as a hedging strategy against high volatility, we observe algorithmic stablecoins making their way up. These algorithmic stablecoins, thought to be more capital efficient, are not backed by any collateral but rather rely on smart contract logic to manipulate supply and demand.

The history of stable assets proved that maintaining an unwavering peg is very hard to achieve, with multiple projects failing. On multiple occasions, we see the peg fluctuating above or below target price frames, but projects are quick to intervene to make the price return to healthy bounds. However, the most recent incident with UST (Terra’s USD-pegged stablecoin), ended up in the death spiral of losing value. Many experts claim that this was foreseeable, with the mechanism being flawed and with the potential to be exploited.

The Stablecoin market has seen exponential growth since 2021; as of 2023, the market cap of cryptocurrencies comprises around 10-11% stablecoin, making it still a growing sector with a $120B market cap (04.2023).

Role of stablecoins

Stablecoins serve as an alternative to ever-volatile cryptocurrencies by pegging to fiat currencies, which in comparison, are more stable. Their role in the crypto world is undisputed, as even risk-tolerant investors may find crypto's volatility too much to handle. They have been considered a safe investment, and various crashes have highlighted the fact that there is no such thing as a risk-free asset.

Stablecoins function in the crypto space as a primary medium of payment, collateral, and store of value. In addition, stablecoins are considerably helpful for those living in countries with unstable (or unreliable) fiat currencies.

In the scenario of hyperinflation or government intervention, people may decide to purchase valuable metals like gold or foreign currencies, such as US dollars or euros. However, in critical economic situations, local banks may not be able to provide enough foreign currency. In many developing countries where the banking infrastructure is inadequate, blockchain-based stablecoins may be the only feasible solution.

Technical aspects

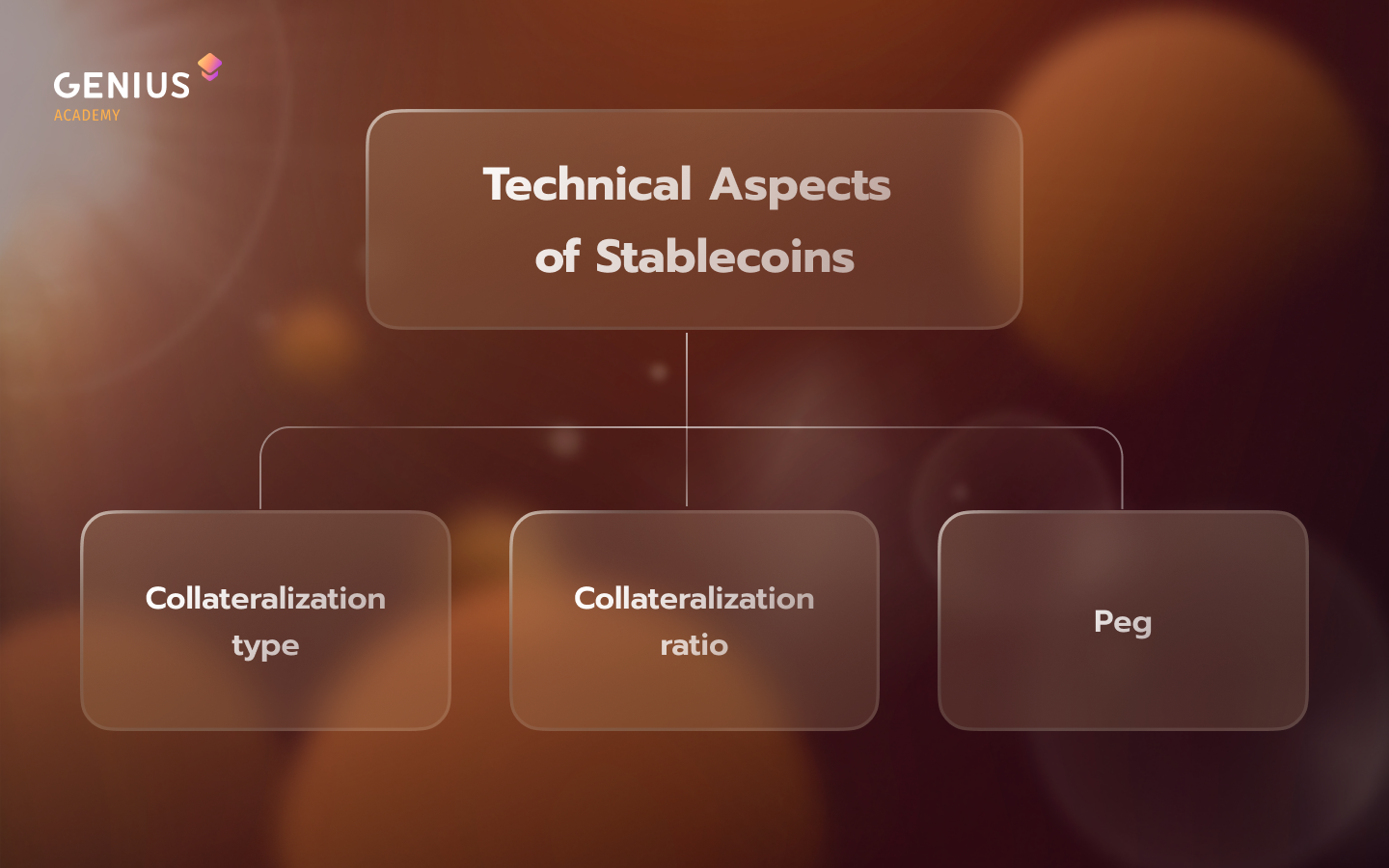

Stable assets aim to stabilize their price to maintain a certain value. To achieve that, projects rely on a variety of different mechanisms and attributes. Depending on the priorities behind a stablecoin, the design of the protocol will change.

Stablecoins that we see currently on the market offer a wide range of characteristics. We can differentiate between them by looking at three elements: collateralization type, collateralization ratio, and peg.

Collateralization types

Stablecoins can have reserves backing them in various forms: fiat currencies, cryptocurrencies, commodities, financial instruments, or simply real-world assets. Stablecoin backing is the most commonly used characteristic to distinguish between their types:

- Fiat-backed

Stablecoins such as USDC hold their US dollar reserves in banks, which play the role of custodians. Usually, this type of stablecoin is considered to be the most reliable but least decentralized.

- Crypto-backed

Crypto-backed stablecoins, such as DAI, use cryptocurrencies as reserves to back their stablecoins. Depending on the project, the collateral may be exogenous vs. endogenous vs. implicit.

Important to note:

There are numerous misunderstandings surrounding crypto-backed stablecoins, resulting in communities labeling them as algorithmic stablecoins when, in reality, they use stabilization algorithms to support their peg, not maintain it. This has occurred with stablecoins such as DAI, DJED, and many others. Referring to them as algorithmic stablecoins implies that they do not have reserves, which is untrue in these cases.

- Commodity-backed

Stablecoins, such as PAX Gold (PAXG), peg their value to the price of an underlying commodity, in this case, 1 ounce of gold.

- Non-collateralized (algorithmic stablecoins)

By their definition, algorithmic stablecoins do not have collateral and rely only on demand/supply mechanisms and incentives to hold the peg. They emerged as a way to provide decentralized and capital-efficient assets. We can observe three types of algorithmic stablecoins: rebase (single-token and dual-token) seigniorage and fractional algorithmic stablecoins.

Collateralization ratio

Another characteristic that describes a stablecoin design is the amount of collateralization behind a given stable asset. Stablecoins can be 1:1 backed, overcollateralized, or partially collateralized.

- 1:1 backed

Fiat-backed stablecoins are the most common examples where the collateral is backed on a 1:1 basis, with prominent examples on the market, such as USDC or USDT.

- Overcollateralized

We observe most crypto-backed stablecoins implementing over-collateralization as a way to stabilize the effect of market fluctuations on the protocol. The level of over-collateralization varies, with DAI collateralization at a 150% level and above and DJED - between 400% and 800%.

- Partially collateralized

Iron Finance claimed to launch the first partially collateralized stablecoin, called IRON. It, unfortunately, failed as TITAN, a governance token that backed IRON, crashed to 0% in June of 2021. This situation has been named “the world’s first large-scale crypto bank run.”

Peg

Stablecoins peg their value to some external point of reference. Most of the time, these are monetary values in the form of fiat currencies, such as USD or Euro, or the price of metals, such as gold. However, we can observe stablecoins peg their values to alternatives as well, including Consumer Price Index (Frax Finance) or Green Index (Cogito Protocol).

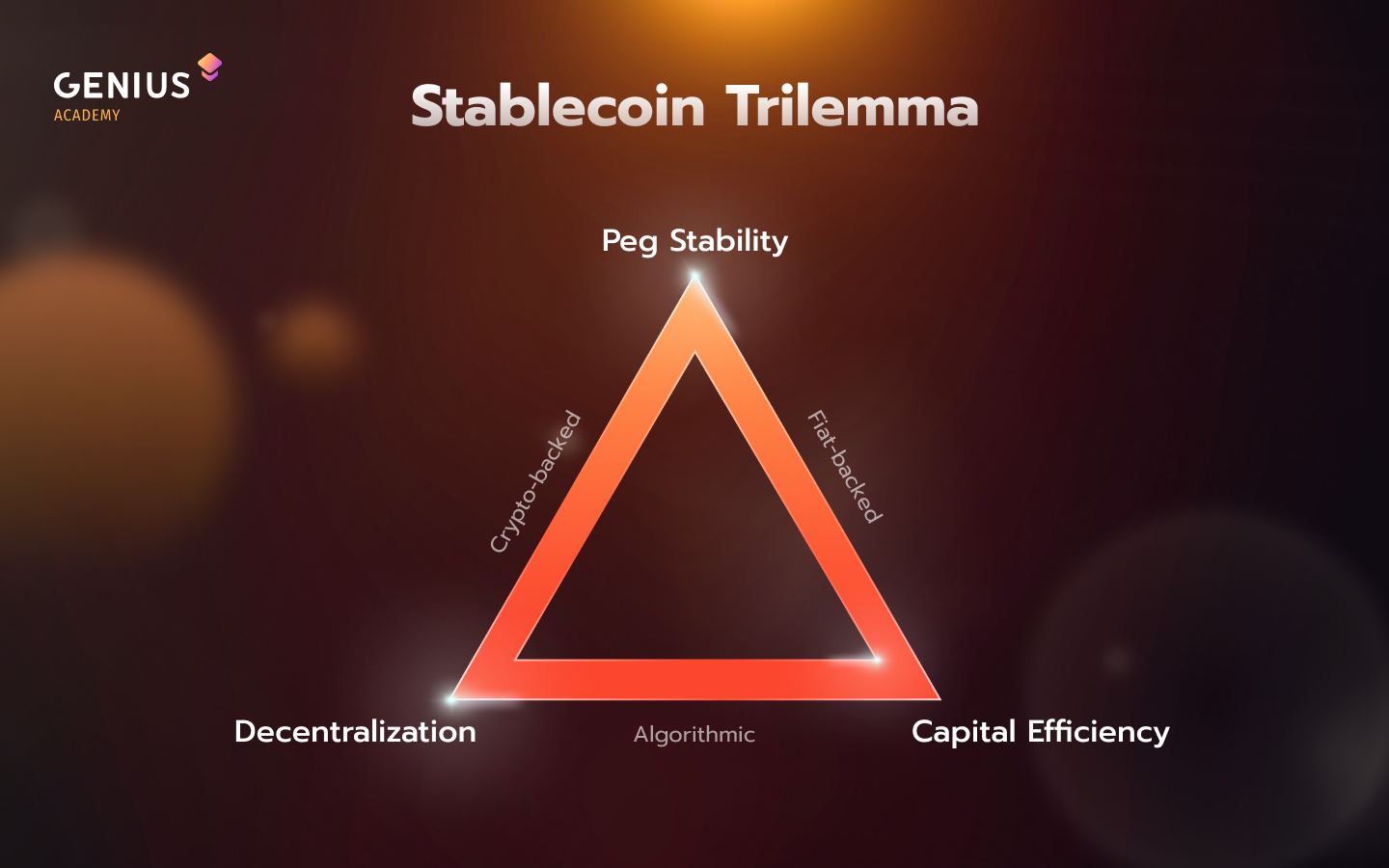

Stablecoin Trilemma

In order to understand the challenges in creating a mechanism behind stablecoins, it is necessary to look at the so-called Stablecoin Trilemma. There are three aspects that such projects need to be aware of: Peg stability, Decentralization, and Capital efficiency. This framework is similar to a blockchain trilemma in which we aim to balance scalability, decentralization, and security.

A 1:1 fiat-backed stablecoin will be stable and capital efficient but not decentralized.

An overcollateralized crypto-backed stablecoin will be stable and decentralized but not capital efficient,

An unbacked algorithmic stablecoin will be capital efficient and decentralized but not stable.

Applications

Stablecoins facilitate crypto-to-crypto transactions as a stable medium of exchange in the volatile crypto landscape. We often see trading pairs on decentralized exchanges that trade stablecoin against another cryptocurrency.

Stablecoins, similarly to assets or fiat currency, can work as a store of value. This is possible because the fiat currency is able to maintain its value better than crypto assets. With fiat-pegged stablecoins, we can use them as a store of value on the decentralized protocols.

Cross-border transfer costs are an obstacle for many people, mostly in developing countries. Having cryptocurrencies, especially stablecoins, enables cheaper payments across borders. Due to the lack of intermediaries in the form of banks, people are able to save time and money while not giving up the custody of their funds.

In a lot of cases, stablecoins are preferred cryptocurrencies used as collateral in lending protocols. Their advantage is the ease of liquidating them if it’s necessary. Overall, stablecoins as collateral is a safer option from the lender's perspective since they have a guarantee that the collateral’s value won’t suddenly drop (supposing there is no depeg or hack).

Risks

Just like all financial assets, blockchain-based stablecoins face a number of risks, which can lead to depegging. Depegging refers to a situation where the value of a stablecoin deviates from its target price. There are many risks that may potentially result in stablecoin depegging.

- Market risk

One of the reasons for depegging may be a drastic demand decrease resulting from economic or political changes (most commonly in stablecoins pegged to bank-issued fiat currency). This particular scenario is especially dangerous as it creates a potential snowball effect when investors, afraid of losses, exit their positions.

- Counterparty risk

This type of risk occurs when one party defaults on their obligations and, as a result, creates losses for the other party. It is greatly reflected in a situation when the Silicon Valley Bank collapsed and Circle (issuer of USDC), having a percentage of reserves in this bank, briefly lost its peg. The risk can be mitigated by implementing diversification, insurance, or hedging to ensure that a single event won’t be able to drastically impact the price stability of a stablecoin - Security risk

Decentralization, which is often touted as a key benefit of stablecoins, can also be a double-edged sword. While it can provide a degree of protection against censorship and government interference, it also opens up the possibility of hacking and other malicious activities. One major security risk for stablecoins is the potential loss of funds. For example, in the case of collateralized stablecoins, if the value of the underlying collateral drops significantly, there is a risk that the stablecoin will become under-collateralized, which can lead to a loss of funds for users holding the stablecoin. This is what happened with BitUSD, which lost its peg in 2015 and ultimately collapsed, leaving many traders with significant losses.

Legal aspects

Stablecoins, similarly to other crypto assets, are still facing regulatory uncertainty. The legal landscape varies by jurisdiction, and as of right now, there is no regulatory framework for stablecoins. Until recently, many economies refrained from harsh regulations not to hinder innovation of the rapidly growing DeFi market. However, the topic of regulations has been getting more attention with guidance on this matter.

One of the key legal issues that stablecoin projects have to face is securities law. The United States of America, with the Securities and Exchange Commission, has been actively conducting research on crypto projects to identify threats that stablecoins pose to consumers. On the 12 of February, SEC informed that it would proceed with enforcement actions after claiming BUSD (Paxos project) is unregistered security. One day later, the NYDFS forced a halt in issuing the BUSD stablecoins.

These digital assets are no exception to anti-money laundering (AML) and know-your-customer (KYC) regulations, as well as tax, consumer protection, and money transmission laws.

Ethics

Centralized stablecoins are thought to be the most trustworthy ones because, as seen in the past, they were less likely to deviate from their target value. However, many blockchain experts that prioritize decentralization criticized fiat-backed stablecoins due to their lack of transparency. Chainlink has proposed its Proof-of-Reserves as a solution to enable the verification of any stablecoin that is backed off-chain.

For traders who rely on stablecoins, it is crucial to conduct thorough research and carefully assess the quality of the project. It is essential to look into how the team deals with legal concerns, audibility, and security to determine how reliable and sustainable the stable assets are in the long run. These factors serve as indicators of the project's ability to withstand potential challenges and ensure that the stablecoin maintains its peg to the intended value.

---

Author:

Cogito Protocol Team.

Cogito Protocol offers a "stablecoin-as-a-service" framework to create AI-driven digital assets with low to medium volatility called “tracercoins.”